- Jacobs started QXO to become leader in building supplies

- Rexel says offer ‘significantly undervalues’ its business

Gift this article

In this Article

Follow

Follow

Follow

Follow

Have a confidential tip for our reporters? Get in TouchBefore it’s here, it’s on the Bloomberg Terminal LEARN MORE

September 16, 2024 at 2:27 PM GMT+7

Updated on

Save

Listen

1:24

Rexel SA shares rose the most in four years after the French electrical equipment supplier rejected a more than $9 billion takeover bid from QXO Inc.

The stock climbed as much as 14% in Paris, and traded 10% higher at 11:19 a.m., valuing the company at €7.6 billion ($8.5 billion). The shares remained below the indicative price range of €28 to €28.40 a share offered by QXO.

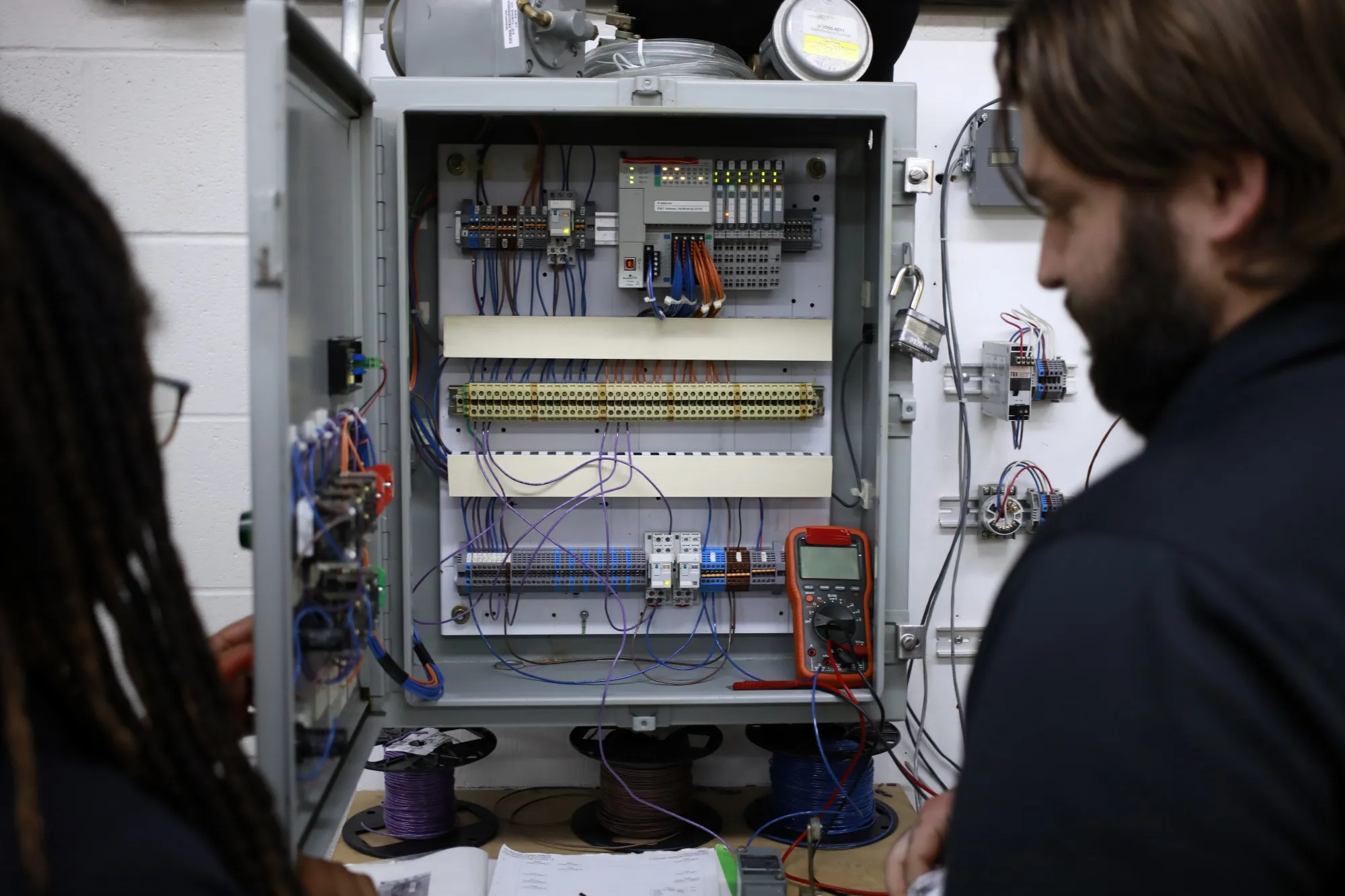

Rexel distributes electrical products and other equipment across industries ranging from utilities to builders and autos. The board reviewed QXO’s unsolicited, non-binding proposal and rejected it on the grounds that it “significantly undervalues” the company and doesn’t reflect its growth potential, it said Sunday.

Citigroup analysts agreed the bid was too low. “We see significant runway for growth at Rexel, both organically and through M&A, especially in the US, and we think that Rexel is well positioned to capitalize on this growth,” the analysts said in a note.

QXO, founded by billionaire and serial company-builder Brad Jacobs, aims to become a leader in building products distribution through acquiring and rolling up existing players in the industry. Jacobs followed a similar playbook to build companies including United Rentals Inc. and XPO Inc.

Reuters first reported the bid and said QXO doesn’t plan to increase the offer, citing people with knowledge of the matter.

(Updates with information on Jacobs from fifth paragraph.)