Gift this article

In this Article

Follow

Have a confidential tip for our reporters? Get in TouchBefore it’s here, it’s on the Bloomberg Terminal LEARN MORE

By Isabelle Lee

September 12, 2024 at 6:30 AM GMT+7

Save

You’re reading 5 Things to Start Your Day, Asia Edition.

Get up to speed with the most important business and markets news each morning.

Bloomberg may send me offers and promotions.

Sign Up

By submitting my information, I agree to the Privacy Policy and Terms of Service.

Good morning. Tech stocks lift the broader market. Bond market ends flirtation with big Fed rate cut. The scramble for Nvidia chips has left some customers frustrated. Here’s what’s moving markets. —Isabelle Lee

Tech rally

A rally in the world’s largest tech companies spurred a stock-market rebound in a volatile session that had Wall Street traders digesting faster-than-anticipated inflation data. The S&P 500 climbed 1.1% and the Nasdaq 100 rallied 2.2%. It was the first time since October 2022 that each gauge erased an intraday loss of at least 1.5%. Chipmakers led gains, with Nvidia up 8%. Treasury two-year yields edged up on bets the Federal Reserve will move gradually with rate cuts.

Cementing bets

The bond market has ended its long flirtation with the Fed cutting rates by half a point this month as resilient inflation and labor market data reinforce a measured course of action. Swaps traders have fully priced in a quarter-point reduction at the Fed’s monetary-policy meeting next week. Whether the economy is entering a soft landing that only requires a series of modest rate cuts, as seen in 2019 and 1995, or heading for a harder landing at some stage next year is the biggest conundrum for investors.

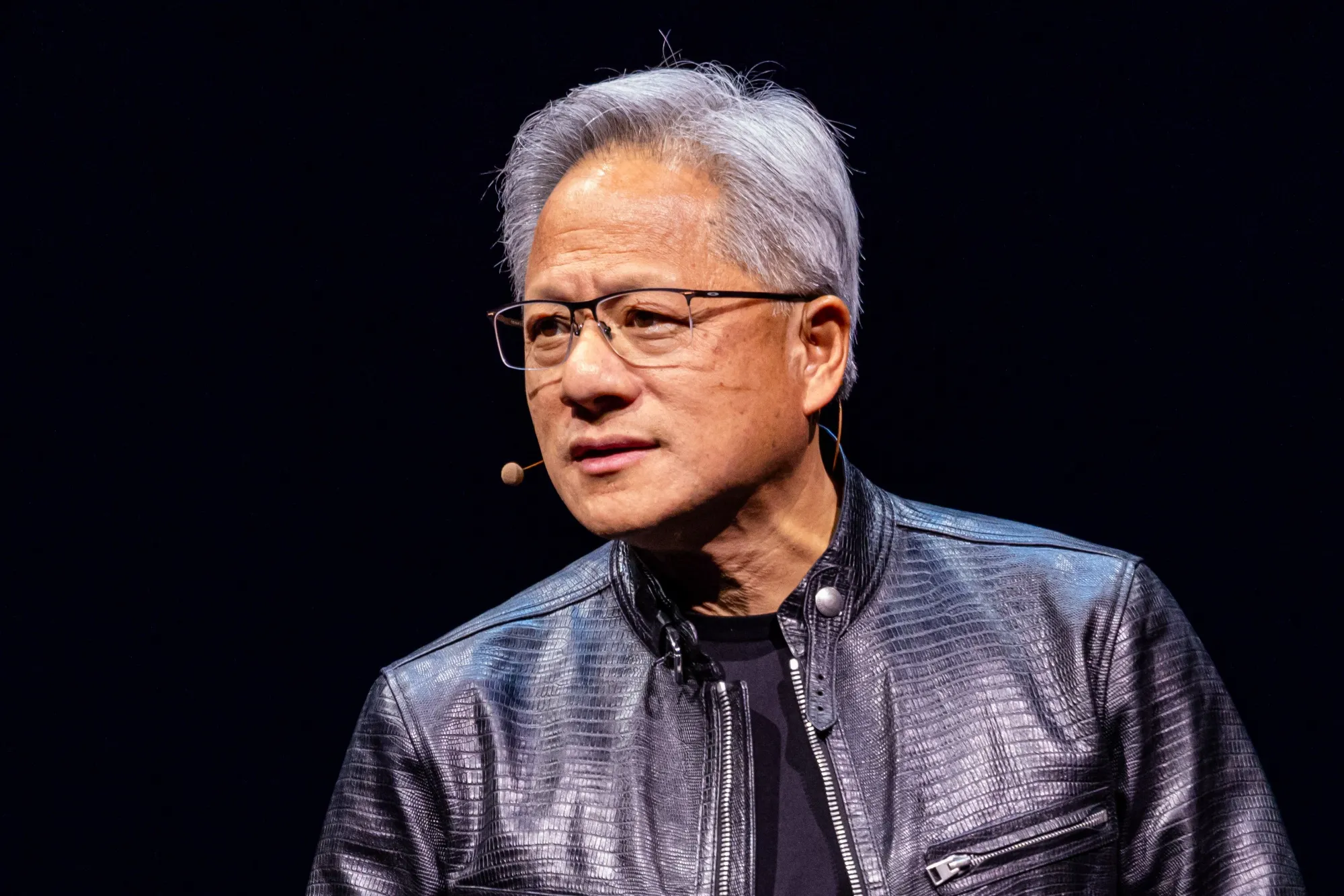

Customer tension

Nvidia CEO Jensen Huang, whose products have become the hottest commodity in the tech world, said the scramble for a limited amount of supply has frustrated customers. “The demand on it is so great, and everyone wants to be first,” he said. “We probably have more emotional customers today. Deservedly so. It’s tense.” Nvidia’s chips are used by data center operators to develop and run AI models. The feverish appetite for such services has sent its sales — and stock price — soaring.

Bearish views

Oil climbed the most in two weeks as Hurricane Francine ripped through key oil-producing zones in the US Gulf of Mexico. WTI rose more than 2% to settle above $67 a barrel, erasing most of the prior day’s plunge. Global benchmark Brent crude advanced to top $70 a barrel. The gain was fueled by short-covering after the storm prompted oil firms to shut in roughly 25% of Gulf crude output, said BOK Financial Securities. Exxon, Shell and other offshore drillers evacuated crews and suspended some operations.

Coming up . . .

It’s a busy economic calendar for traders Thursday. India will report CPI, which likely extended its drop below the Reserve Bank of India’s 4% target in August. The nation will also report industrial production, which likely extended a slowdown to 4.0% growth year on year in July from 4.2% in June amid a decline in exports, according to Bloomberg Economics. Pakistan’s central bank will announce its monetary-policy decision. The State Bank of Pakistan is expected to cut its policy rate by another 100 basis points. Elsewhere, the ECB decides on rates and the US reports weekly jobless claims.

What we’ve been reading

Here’s what caught our eye over the past 24 hours:

- Milei’s veto prevails as Argentina’s congress pivots on key bill

- China, Philippines hold talks as new hotspot emerges in sea row

- China nickel tycoon seeks growth in US energy-storage market

- Trump faces blowback for repeating lie about migrants and pets

- India semiconductor ambition grows with L&T joining chip effort

- Ghana hikes cocoa farmers’ pay by 45% as bank loan stalls

- Coffee is now so expensive that farms are becoming crime scenes

And finally, here’s what Tatiana is interested in today

Stocks sold off hard after the US CPI report signaled some lingering price pressures, but then rebounded. While the weakness might have been a reflection of the presidential debate Tuesday night as well as economic jitters, consumer prices still exceeding producer prices supports corporate margins and bottom lines.

Barring a shock in Thursday’s numbers, the annual measure for PPI is projected to trail CPI by about 0.8 percentage point. A positive spread between the two is typically associated with a solid operating-margin outlook, per Bloomberg Intelligence research.

The caveat is that the spread has been rapidly shrinking, as the chart above shows. That will pose a headwind down the line, but we’re not there just yet.

Tatiana Darie writes for Bloomberg’s Markets Live blog in New York. Follow her on X at @tatianadariee.