- Shares are up 42% this year, sending valuation above sector

- German firm’s US investor base has grown to near-record high

Gift this article

In this Article

Follow

Follow

Follow

Follow

Have a confidential tip for our reporters? Get in TouchBefore it’s here, it’s on the Bloomberg Terminal LEARN MORE

By Henry Ren

September 12, 2024 at 18:24 GMT+7

Save

Listen

4:37

Germany’s SAP SE has long been one of Europe’s most important tech stocks. But it’s now winning more US investor interest — and shaking off a long history of trading at a discount to peers.

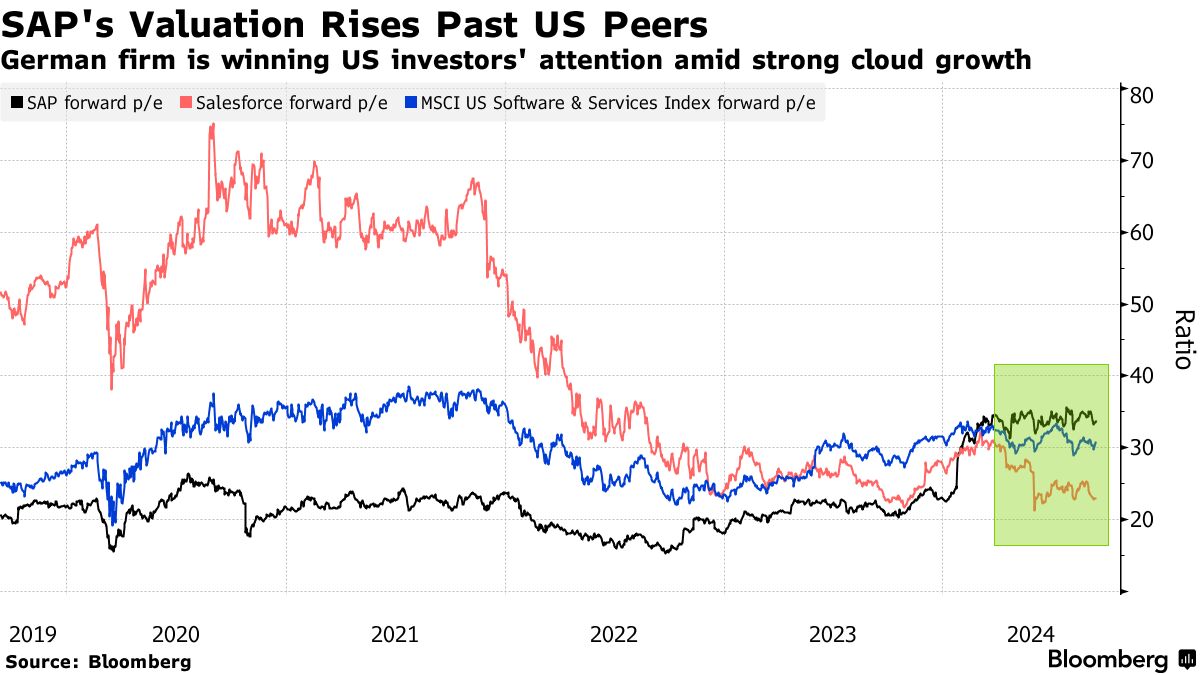

After a 42% rally this year, SAP trades at about 34 times forward earnings, giving it a valuation above an MSCI index of US software and IT services firms for the first time since 2018. SAP has also cemented its valuation premium over US peers including Salesforce Inc. and Oracle Corp., with investors impressed by its success in shifting customers to more lucrative cloud-based products.

“SAP’s results have been strong recently, especially in the context of some weaker reporting from peers,” said Marcus Morris-Eyton, who holds the stock as the third-biggest position in AllianceBernstein’s European growth portfolio. SAP’s latest quarterly results showed 25% growth in cloud revenue — setting it apart from Salesforce and Workday Inc., which have drawn investor concern about slowing growth.

Investors outside of Europe are noticing the German company’s rise, with about 38% of SAP stock now owned by US investors, according to data compiled by Bloomberg. That’s near the highest on record in the data, which covers publicly-reported stock holdings and goes back to 2010.

“SAP has been unloved by US investors due to its lack of growth potential in the past, but that is beginning to flip,” said Ben Barringer, a global technology analyst at Quilter Cheviot.

The company has also been making a concerted effort to broaden its investor base. During the annual Sapphire conference in Orlando last year, Chief Financial Officer Dominik Asam vowed to win more attention from US investors, saying “this is where the battle is won or lost.”

To that end, SAP in October moved the time of its earnings releases to after the New York market close, in line with most big US tech firms. The company generated about one-third of its sales in the US last year.

There’s further to go in winning American investors, according to analysts at Barclays. The company’s US investor base remains small compared with Europe’s other big-cap names, like ASML Holding NV and Novo Nordisk A/S, and can expand as SAP impresses investors with its results and dedicated US communications, they wrote in a research report last month.

SAP’s US Investor Base Trails Some Other European Big-Caps

US holders own 38% of SAP, a ratio less than ASML, Novo Nordisk

Source: Bloomberg

Note: Based upon publicly reported holdings, not total shares outstanding. Data as of Sept. 8.

SAP’s newfound popularity hasn’t come easy. It was seen as a latecomer in the cloud transition, but efforts to shift users to the more lucrative subscription model and away from on-premise licenses are now bearing fruit.

SAP has promoted its cloud business by bundling it with artificial intelligence tools, and the upgrade cycle likely has more room to run. About one-third of the company’s 35,000 customers are yet to transition from legacy systems to the newer S/4 HANA program, according to an estimate by Bank of America.

Still, the European software giant faces some of the same issues as its US peers. One uncertainty is how long the benefit of migration to the cloud will last. Analysts on average expect revenue growth to increase from about 9% this year to 11% for the following two, before moderating in 2027, the deadline that the company set for clients to change to newer systems.

And there’s also the question of monetizing AI features. So far, SAP has mostly used AI tools as a way to entice customers to migrate to cloud-based software, instead of charging higher prices for its products, said Oddo BHF analyst Nicolas David.

Nonetheless, SAP’s rising valuation shows that investors in Europe — and increasingly the US — are willing to pay a higher price for SAP shares during this phase of high growth.

“SAP attracting more interest from US investors is a positive, and shows that the stock is now compelling on a global basis given the acceleration in both revenue growth, and margins,” said AllianceBernstein’s Morris-Eyton.

Top Tech Stories

- Nvidia Chief Executive Officer Jensen Huang, whose products have become the hottest commodity in the technology world, said that the scramble for a limited amount of supply has frustrated some customers and raised tensions.

- OpenAI is in talks to raise $6.5 billion from investors at a valuation of $150 billion, according to people familiar with the situation.

- China has strongly advised its carmakers to make sure advanced electric vehicle technology stays in the country, people familiar with the matter said, even as they build factories around the world to escape punitive tariffs on Chinese exports.

- Venture capital giant Sequoia Capital believes the bulk of billion-dollar companies created in artificial intelligence will come from making applications rather than building models, although it is investing in both, partner Pat Grady said at a conference Wednesday.

Earnings Due Thursday

- Postmarket

- Adobe

— With assistance from Subrat Patnaik and Amy Thomson