August 5, 2024

One of the frequent questions that clients ask Goldman Sachs Research’s Kamakshya Trivedi is whether the pound can regain the levels it traded at before Brexit in 2016. While he expects the pound to rally against the US dollar and the euro over the coming year, Trivedi, the head of Global Foreign Exchange, Interest Rates and Emerging Markets Strategy Research, says the pound is unlikely return to those levels anytime soon.

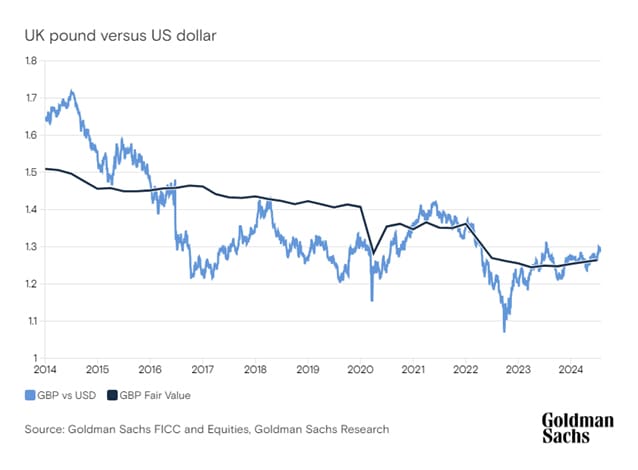

Goldman Sachs Research’s estimate of fair value is around £1.25 versus the dollar, compared with around £1.45 just before Britons voted to leave the EU.

“If you are going to have a big disruption in the trading arrangements with one of your largest trading partners, which is what Brexit included, there is going to be an impact on the currency,” Trivedi says. “In fact, currency weakness is one way you can adjust to that kind of disruption.”

The Labour Party, which won a majority in the July elections, is aiming for a better relationship with the EU, but there’s no indication Prime Minister Keir Starmer will seek to rejoin the bloc. “The Labour government’s policies are clearly not to reverse Brexit,” Trivedi says. “They do want to achieve a better, smoother trading relationship with the EU. To the extent that you can get to a better place in terms of that relationship, that should be supportive of the currency.”

Trivedi points out that Brexit isn’t the only thing that has influenced the pound’s valuation during the past eight years. The currency has also “depreciated relative to the dollar, because you had a decade of running somewhat higher inflation in the UK compared to the US,” he says.

Will the pound strengthen further?

While it may not reach pre-Brexit levels, there are reasons to expect the pound, the only G-10 currency that has outperformed the US dollar this year, to strengthenfurther. Goldman Sachs Research recently raised its 12-month target for the British pound versus the dollar to £1.32 (from £1.28 previously). The currency rose to £1.30 in July against the greenback, its highest level in a year. (The pound traded at around £1.70 to the US currency in July 2014, two years before the Brexit vote.)

“The pound typically does well in a friendly global macro outlook,” he says. Traders and investors are beginning to relax about the risks of inflation, and worries of recession have faded. When equity markets are trading firmly, and interest rates are moving in a range or even declining, the British currency tends to perform strongly.

UK economic growth has been stronger in recent months, exceeding consensus estimates in some instances, Trivedi says. While wage and services inflation are still elevated, headline inflation has fallen to about 2%.

Importantly, Trivedi says, the UK has become less of an outlier when it comes to monetary policy, which has been one of the things keeping the pound lower in recent years. “The Bank of England was perceived to have had a dovish reaction in response to the economic data, where you had inflation that was still pretty high,” he says. “That’s changed. Now a lot of global central banks have started easing policy.”

The European Central Bank, the Bank of Canada, and Sweden’s Riksbank have cut their policy rates this year. Goldman Sachs Research expects the Federal Reserve to cut rates in September.

The BoE lowered interest rates on Aug. 1. “A cut in August or later is less important from a currency standpoint than the fact that, in a relative sense, the BoE is now solidly in the middle of the pack of global central banks that are easing rates,” Trivedi says. “The BoE is no longer a dovish outlier, which means monetary policy should not hold the pound back.”

Political turmoil appears to be fading

Brexit was a volatile period for the UK, and the country has had a number of instances of political turmoil since then, including a rapid turnover of four prime ministers since the onset of the Covid pandemic in 2020 and six prime ministers since the Brexit referendum.

“That created lots of uncertainty around where the eventual policy framework was going to land,” Trivedi says. “And that made it harder for investors to commit capital to the UK.”

Nearly a decade after the referendum, the UK is starting to appear relatively calm compared to some other G-10 economies. “The UK policy mix appears to be a bit more stable compared to some places on the continent, like France, or even relative to the US, which has an election coming up.”

“On that relative basis, I think global investors are going to be looking more favorably at UK assets,” Trivedi adds.

What are the risks to the UK pound?

One risk to the UK and the rest of Europe is that Donald Trump wins the US election in November and follows through with imposing major tariffs. If that happens, “it would be pretty painful for the euro area,” Trivedi says. “The pound has some sensitivity to that as well. While it may not be the most directly targeted, it will still feel the impact. A global trade war is never good for a currency of an open economy like the UK.”

And the new Labour government will have to show that it can deliver on its ambitions to increase economic growth and productivity, Trivedi says. “That is obviously still an ambition and not a reality. So we have to see how that plays out,” he adds.

This article is being provided for educational purposes only. The information contained in this article does not constitute a recommendation from any Goldman Sachs entity to the recipient, and Goldman Sachs is not providing any financial, economic, legal, investment, accounting, or tax advice through this article or to its recipient. Neither Goldman Sachs nor any of its affiliates makes any representation or warranty, express or implied, as to the accuracy or completeness of the statements or any information contained in this article and any liability therefore (including in respect of direct, indirect, or consequential loss or damage) is expressly disclaimed.