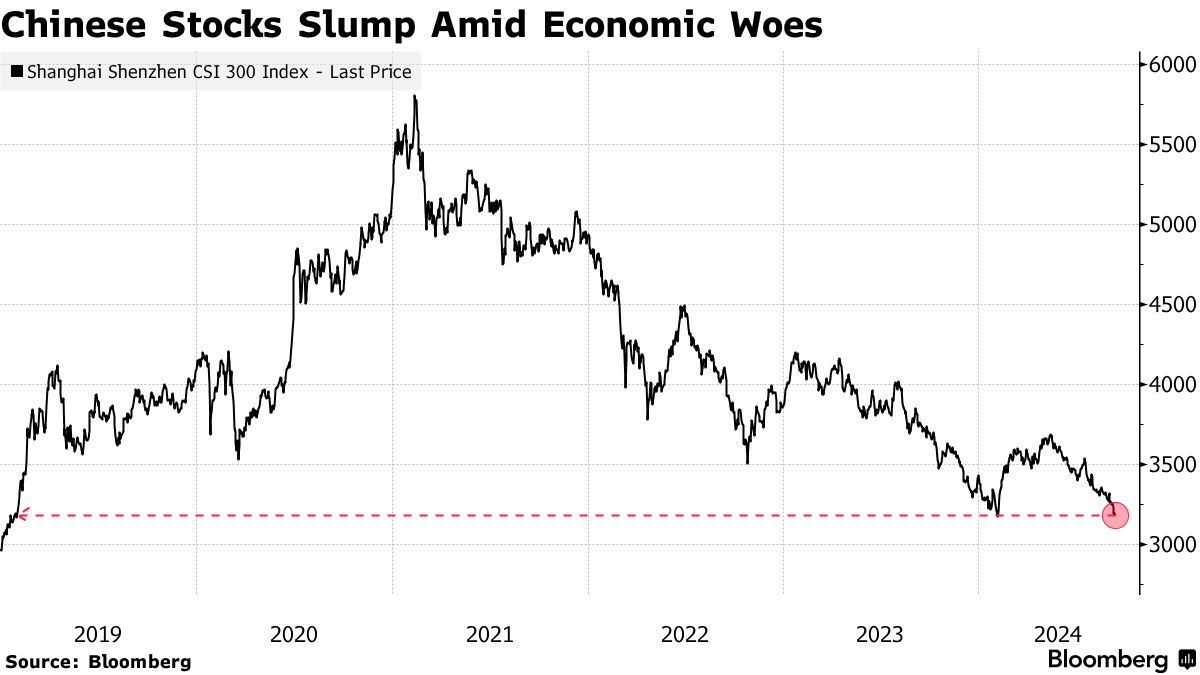

- Economic gloom, lack of earnings recovery hurt sentiment

- CSI 300 Index is headed for a record fourth year of losses

Gift this article

Have a confidential tip for our reporters? Get in TouchBefore it’s here, it’s on the Bloomberg Terminal LEARN MORE

By Abhishek Vishnoi and Winnie Hsu

September 12, 2024 at 2:02 PM GMT+7

Save

Listen

2:33

Chinese stocks fell to the lowest since January 2019, a grim reflection of how investors have lost faith over a recovery in the country’s earnings and economy.

The CSI 300 Index closed down 0.4% on Thursday, taking its slide since a May high to around 14%. The benchmark of onshore shares is also headed for an unprecedented fourth straight year of losses.

Confidence in China’s near-term recovery has dwindled as a years-long property crisis hurts consumption and threatens the country’s growth target of around 5%. In another blow to sentiment, geopolitical tensions are rising ahead of the November US presidential elections. Both candidates firmed up their anti-China rhetoric during the debate that aired Wednesday in Asia.

“The depth and entrenchment of challenges such as disinflationary pressures, anemic consumption, and an extended property slump have now become apparent,” said Nathan Chow, senior economist at DBS Bank (Hong Kong) Ltd. “This growing realization of entrenched risks has shifted market sentiment sharply bearish.”

Read more: China’s $6.5 Trillion Stock Rout Worsens Economic Peril for Xi

China has taken steps to address the market’s weakness this year, including state funds’ purchases of exchange-traded funds and stronger oversight of short-selling and quant trading activities. While the measures have spurred a rally from February through mid-May, the slide since then suggests traders want a fundamental fix to the property woes and a more business-friendly environment.

The risk for Xi Jinping’s government is that the extended market slump may further erode confidence and dim the prospect of an economic recovery in a negative feedback loop. Data for August so far shows the economy struggling to regain momentum. Factory activity contracted for a fourth straight month, while core inflation cooled to the weakest in more than three years.

In a worrying sign of what may come as the US election nears, both presidential candidates deployed rhetorical attacks against China during this week’s debate.

Vice President Kamala Harris slammed her rival and former President Donald Trump for not protecting American interests against China. Trump indicated again that he’d further hike tariffs on China if elected in November.

Read more: Harris Says Trump ‘Sold Us Out’ to China, Slams His Praise of Xi

“On top of China-US relations as both presidential candidates are anti-China, macro factors are also affecting the investment sentiment,” said Kenny Wen, head of investment strategy at KGI Asia Ltd. “Technically, if the CSI 300 breaks this year’s support level, there may be another round of selling pressure. The index may further test the low in 2019 or an even lower level.”

Get Alerts for: